Regular Household Costs, Less Fixed Income

Core household costs, such as housing (mortgage, rent, and/or real estate taxes) and utilities, usually come every month, regardless of market conditions. Those costs usually can’t be reduced—and they have to be paid, even in a down market.

Meanwhile, pensions that provide guaranteed income have become an increasingly rare part of retirement income. Most people have retirement savings in accounts such as 401(k)s, 403(b)s, or in other investment portfolios.

That means, to meet your core expenses, you may need to take out a higher percentage of assets from your retirement investment portfolio. And those assets won’t be in your portfolio should the markets recover.

The Two Phases of Retirement

Retirement has two phases: the savings period, commonly called the accumulation phase, and the withdrawal period when you tap your savings to cover your living costs, also called the distribution phase.

Accumulation

During this active saving time, your portfolio’s average return is an important factor. The risk of a short-term market down turn is lessened by the fact that you have time on your side to make up some of those losses. Volatility during this phase is a factor—but not necessarily the most important one.

Distribution

During this time, the sequence of returns matters. The risk of a short-term down market in the beginning stages of retirement can make the difference between passing on a sizable estate or running out of money down the road. Market volatility can be very disruptive.

Timing Matters: Here’s an Example

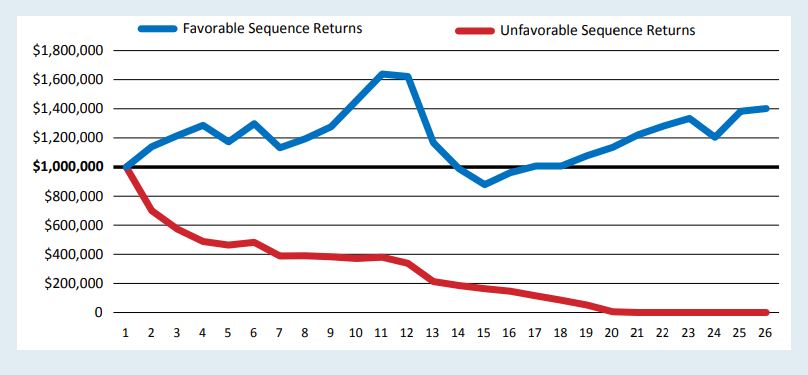

A client retires with $1 million and withdraws $50,000 each year for 25 years. Both scenarios depict an average 6.2% return, and each line depicts a different scenario: the red line shows a down market during early retirement, while the darker blue line shows a rising market in the beginning of retirement that shifts to a down market later on.

The example provided is hypothetical and intended to illustrate the concepts discussed throughout.

The graphic does not consider the effect of fees, expenses, or other costs that will effect investing

outcomes. Any actual performance results will differ from the hypothetical situation illustrated

here. Past performance is not indicative of future results. Please consult a professional to help you

evaluate your situation before implementing any of the strategies discussed herein.

The timing of the down market makes the difference between passing away with $1.4 million or running out of money in year 20 of retirement.

The Role Annuities Can Play in Retirement-Income Planning

Annuities may help alleviate concerns about running out of income during your life span.

The regular income stream can manage two challenges:

- Reduced need to tap the portfolio during a down market: Annuity benefit payments could cover core expenses, rather than a higher percentage of portfolio assets than anticipated during planning.

- Continued income even after portfolio depletion: A lifetime annuity provides income each year throughout retirement. In this case, the person would still have money coming in the door even after year 20.

Additional Considerations About Annuities

While annuities can be useful retirement-income tools, they may not be the right ones for your needs. Here are a few things to keep in mind when you choose an annuity:

- Distributions are taxed as ordinary income, not capital gains. Investment growth might be tax-deferred. However, payments get added to your ordinary income. Not only does that mean the tax rate is often higher (for tax year 2023, the IRS’ top income tax rate is 37% versus 20% for capital gains)1. In addition, the payments could push you into a higher tax bracket.

- You’ll face tax implications if you withdraw money before you reach age 59½. The IRS will hit you with a 10% early withdrawal penalty if you pull out principal before then. Plus the withdrawal amount will also get added to your ordinary income, with the associated risk of tipping into the next tax bracket.

- You’ll pay to take your money out before your contract is up. The annuity issuer counts on having your principal for the term of the annuity. Their return commitment is based on being able to invest that money during that time. The penalty, called a surrender charge, discourages you from withdrawing your principal early and also helps the issuer recoup returns you received that they won’t have the chance to earn on your investment. The earlier into the contract term you withdraw principal, the higher the surrender charge will be.

- The annuity issuer’s stability can be a risk—so pick carefully in most situations. You’ll only receive the income you’re planning for while the company remains in business to pay it.

- Commission costs can be a consideration. Annuities are known for having higher commission charges. That’s why it’s important to work with a Financial Advisor you trust— and ask questions about why your advisor believes an annuity is right for you.

Building Your Retirement Plan: Considering All the Angles

Market conditions are simply one aspect you should consider when developing your retirement plan.

Your lifestyle goals, potential life span, health care concerns, and legacy desires are other things that influence your plan. Working with us can ease the process of building a plan that helps you progress toward the retirement you envision.

Working With Janney

Depending on your financial needs and personal preferences, you may opt to engage in a brokerage relationship, an advisory relationship or a combination of both. Each time you open an account, we will make recommendations on which type of relationship is in your best interest based on the information you provide when you complete or update your client profile.

When you engage in an advisory relationship, you will pay an asset-based fee which encompasses, among other things, a defined investment strategy, ongoing monitoring, and performance reporting. Your Financial Advisor will serve in a fiduciary capacity for your advisory accounts.

For more information about Janney, please see Janney’s Relationship Summary (Form CRS) on www.janney.com/crs which details all material facts about the scope and terms of our relationship with you and any potential conflicts of interest.

By establishing a relationship with us, we can build a tailored financial plan and make recommendations about solutions that are aligned with your best interest and unique needs, goals, and preferences.

Contact us today to discuss how we can put a plan in place designed to help you reach your financial goals.

1. There are a few exceptions where capital gains may be taxed at rates greater than 20%. Visit https://www.irs.gov/taxtopics/tc409 for details.

Annuities are offered by prospectus. Any product guarantees are subject to the claims paying ability of the issuing insurance company. Many annuities have surrender charges and other fees and expenses that may apply, consider these expenses as they apply to your specific circumstances. There is no assurance that any specific investment, annuity product, or strategy will be successful. Janney makes no representation that an account will obtain gains or losses similar to those illustrated. This is being provided solely for informational and illustrative purposes, is not an offer to sell or a solicitation of an offer to buy the securities highlighted. The information provided should also not be relied on for accounting, legal, or tax advice. The factual information given herein is taken from sources that we believe to be reliable, but is not guaranteed as to accuracy or completeness. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation or needs of individual investors. Janney makes no representation that an individual will obtain gains or losses similar to those illustrated. The concepts illustrated here have legal, accounting and tax implications.

Janney Montgomery Scott LLC, its affiliates, and its employees are not in the business of providing tax, regulatory, accounting, or legal advice. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

Related Articles

-

Financial Planning

10 Key Changes to the SECURE 2.0 Act

Saving for retirement is getting easier in 2024 thanks to SECURE 2.0. Here, we outline highlights... -

Insurance & Annuities

Insurance Solutions at Janney

Janney offers a variety of insurance solutions to help meet your individual needs and preferences... -

Insurance & Annuities

Reposition Assets for Tax-Efficient Wealth Transfer

If you’re close to or in retirement and asking yourself how you can best pass your wealth on to y...